A Harmonized System (HS) code is used to identify a product or commodity within a country's tariff schedule. HS codes must be specified for all physical products and commodities that are imported so that the correct import duty can be assessed.

Whether you're importing a live chicken, a gold bullion or a smartphone there is only a single HS code within each country's tariff that represents that specific product or commodity.

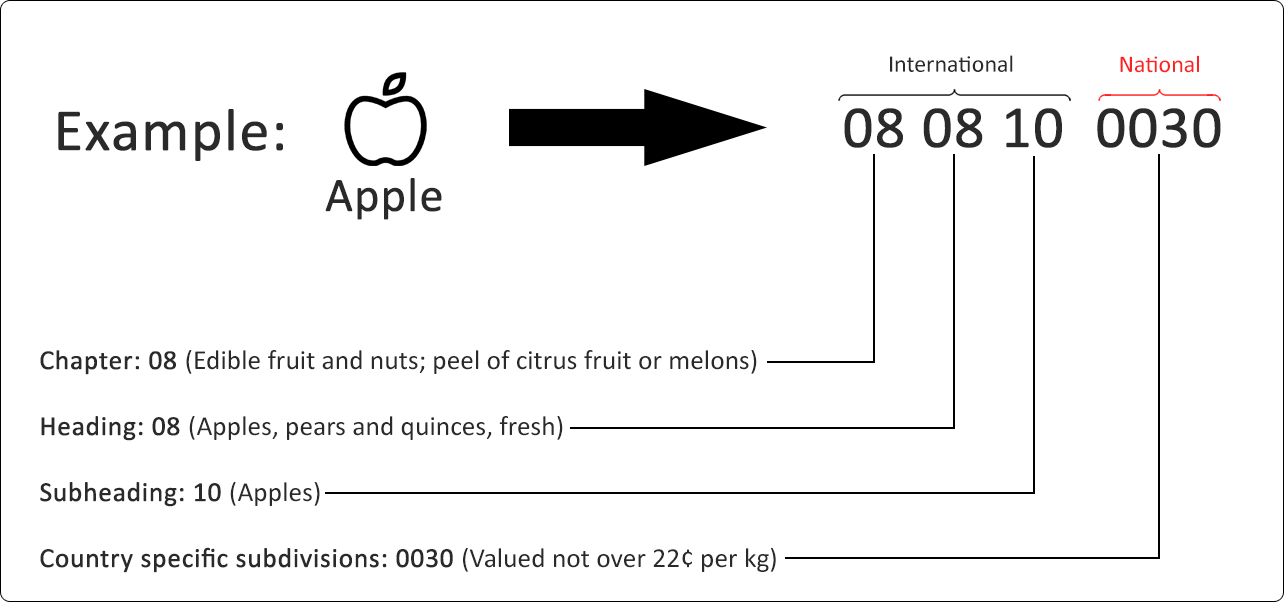

HS codes vary in length, but are typically 8 to 12 digits long. The first six digits of the HS code are harmonized between all World Trade Organization (WTO) countries, but the remaining digits (and letters in some cases) are specific to the import country. As a result, even if you know the HS code for a smartphone for the United States, the HS code for Australia will be different (with the exception of the first six digits). One exception to this rule is customs unions (such as the European Union), in which there is a common tariff that is used by all member countries.

HS codes are broken down into:

- Chapter (first two digits)

- Heading (second two digits)

- Subheading (third two digits)

- Country specific subdivisions (all remaining digits/letters)

Here is a visual breakdown of how a HS code is structured:

While technically the term “HS code” refers specifically to the first six digits of the full import code, the term is more commonly used to describe the full country specific commodity code. Whenever you get a HS code from us, it's the full-length country specific code.